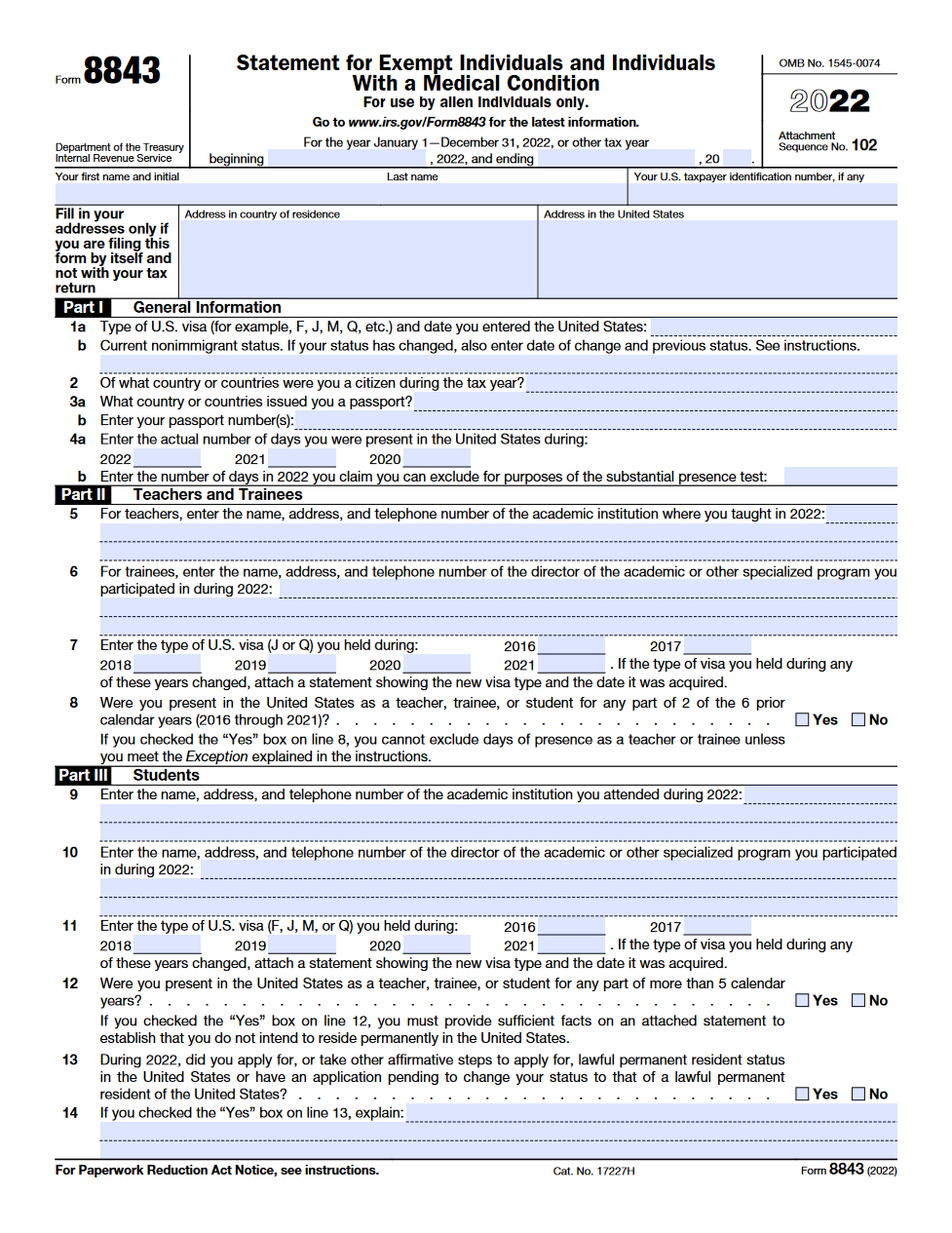

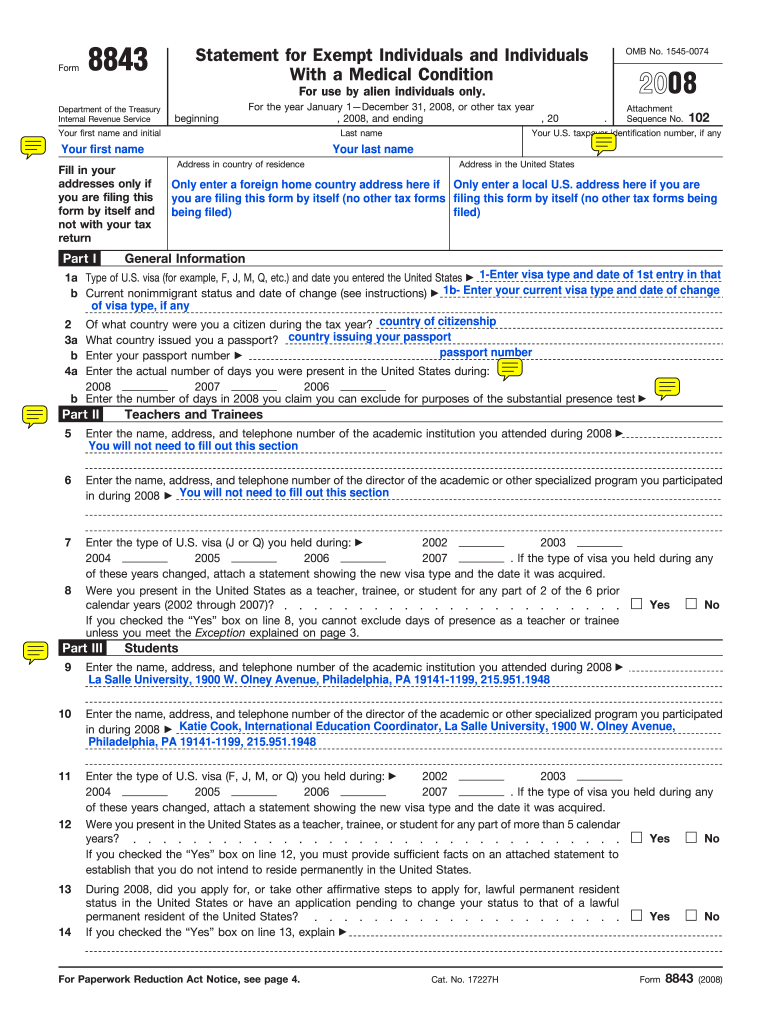

8843 Form 2025. Form 8843 filing for canadian f1 visa holders: If you were an f‐1 or j‐1 student in the usa and you are considered exempt from filing resident taxes (meaning you did not meet the requirements of the substantial presence.

Form 8843, used by nonresident aliens to claim exemption from the substantial presence test for tax purposes in the us, has different filing. The point of the 8843 is that the days you spent in the us as a student don’t count for the “substantial presence test” which determines whether you’re considered a resident of the us.

8843 Form 2025 Images References :

Source: erinaqclementine.pages.dev

Source: erinaqclementine.pages.dev

Form 8843 2025 Amalee Mickie, Even if you did not work or receive income in the united states you are still legally obliged to file a federal tax return with a form 8843 with the irs to declare no earnings.

Source: www.scribd.com

Source: www.scribd.com

Form_8843_for_Scholars Government Information Government Of The, Form 8843 is not an income tax return.

Source: printableformsfree.com

Source: printableformsfree.com

Form 8843 Fillable Printable Forms Free Online, If you need to complete and submit form 8843 as your only tax form for the filing year, send.

Source: www.scribd.com

Source: www.scribd.com

Form 8843 2019 PDF, Carefully review the specific categories listed in the form instructions and ensure you qualify.

Source: www.formsbirds.com

Source: www.formsbirds.com

Form 8843 Statement for Exempt Individuals and Individuals with a, Key points to remember for form 8843:

Source: www.careerpage.co.za

Source: www.careerpage.co.za

SA Army Application Forms 2025 PDF All Forms Here, Generally, most international students & scholars who.

Source: www.youtube.com

Source: www.youtube.com

TAX FILING for F1 STUDENTS with NO Form 8843 YouTube, In f/j status at any time in 2024 but didn't have any u.s.

Source: form-8843.com

Source: form-8843.com

IRS Form 8843 Editable and Printable Statement to Fill out, Tax calculations due to exempt status or a.

Source: www.youtube.com

Source: www.youtube.com

8843 Form Tutorial YouTube, How to fill out form 8843 easily online with sprintax.

Source: form-8848.com

Source: form-8848.com

form 8843 example Fill Online, Printable, Fillable Blank, Generally, most international students & scholars who.

Category: 2025