Ira Limits 2025 Income Guidelines. Key changes for 2025 retirement plan contribution limits. In 2025, the contribution limit for traditional and roth iras remains at $7,000.

Roth ira income limits for 2025. Key income tax relief options in 2025 1.

Ira Limits 2025 Income Guidelines Images References :

Source: nicholasbuckland.pages.dev

Source: nicholasbuckland.pages.dev

Roth Ira Contribution Limits 2025 Agi Nicholas Buckland, Relaxation in tax return filing.

Source: elizabethyoung.pages.dev

Source: elizabethyoung.pages.dev

Roth Ira Contribution Limits 2025 Capital Gains Elizabeth Young, 1, which includes new adjusted gross income and.

Source: maryanderson.pages.dev

Source: maryanderson.pages.dev

401k Roth Ira Contribution Limits 2025 Mary Anderson, The standard deduction for salaried taxpayers in 2025 is ₹60,000, up from.

Source: judibjanifer.pages.dev

Source: judibjanifer.pages.dev

Roth Ira Limits 2025 Dell Ofelia, 401 (k), 403 (b), 457 plans:

Source: alandavidson.pages.dev

Source: alandavidson.pages.dev

Simple Ira Contribution Limits 2025 Over 50 Natalie Baker, Information about ira contribution limits.

Source: tansyyflorrie.pages.dev

Source: tansyyflorrie.pages.dev

Traditional Ira Contribution Limits 2025 Mari Annaliese, The contribution limits for iras in 2025 remain unchanged from 2024.

Source: denisebmalissia.pages.dev

Source: denisebmalissia.pages.dev

Roth Ira Max 2025 Ted Kristin, In 2025, the contribution limit for traditional and roth iras remains at $7,000.

Source: carlmorrison.pages.dev

Source: carlmorrison.pages.dev

401a Limit 2025 Carl Morrison, However, the irs will hold the ira annual contribution limits constant from 2024 to 2025 at $7,000.

Source: www.modwm.com

Source: www.modwm.com

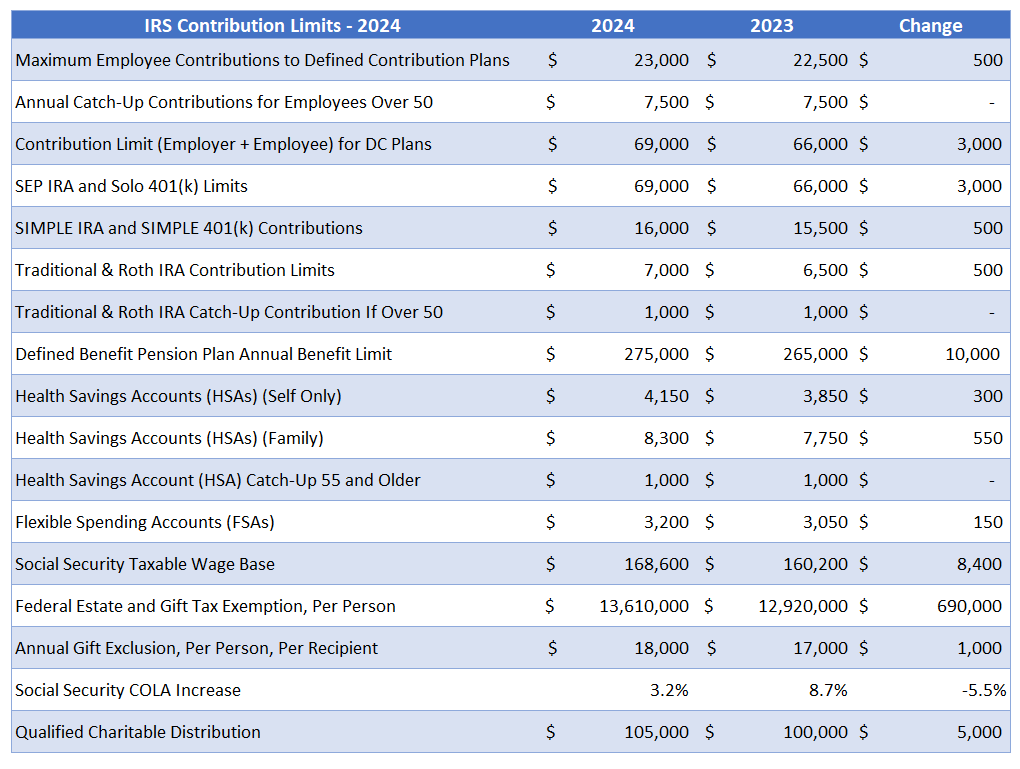

2025 401(k) and IRA Contribution Limits Modern Wealth Management, Information about ira contribution limits.

Source: cameronogden.pages.dev

Source: cameronogden.pages.dev

Simple Ira Limits 2025 Cameron Ogden, The updated guidelines will be applicable with effect from january 1, 2025.

2025