Roth Ira Limit 2024 Income 2024. The same combined contribution limit applies to all of your roth and traditional iras. There are also income limits.

The roth ira income limits will increase in 2024. The income limit for contributions to a roth ira for tax year 2025 is slightly higher from 2024 levels.

Roth Ira Limit 2024 Income 2024 Images References :

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, The irs's annual ira contribution limit covers contributions to all personal iras, including both traditional iras and.

Source: carliebtabbatha.pages.dev

Source: carliebtabbatha.pages.dev

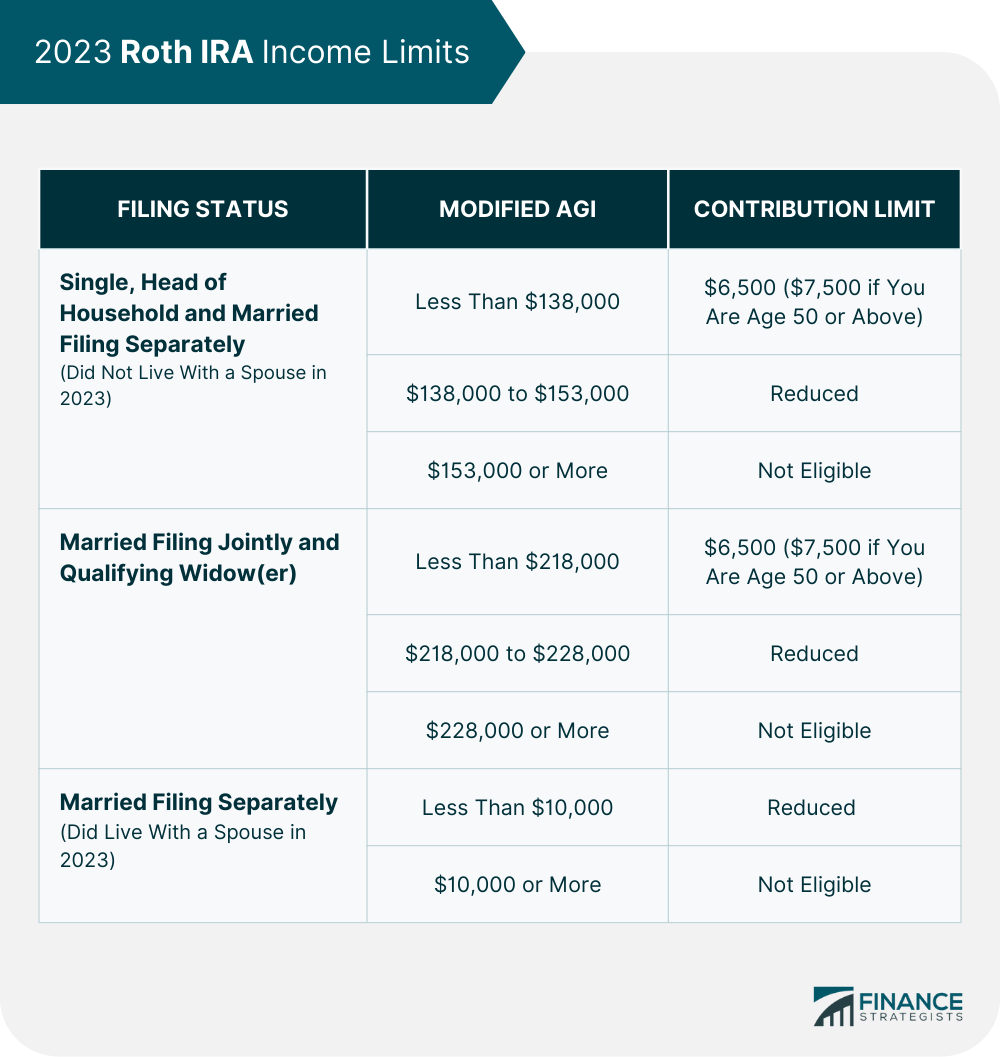

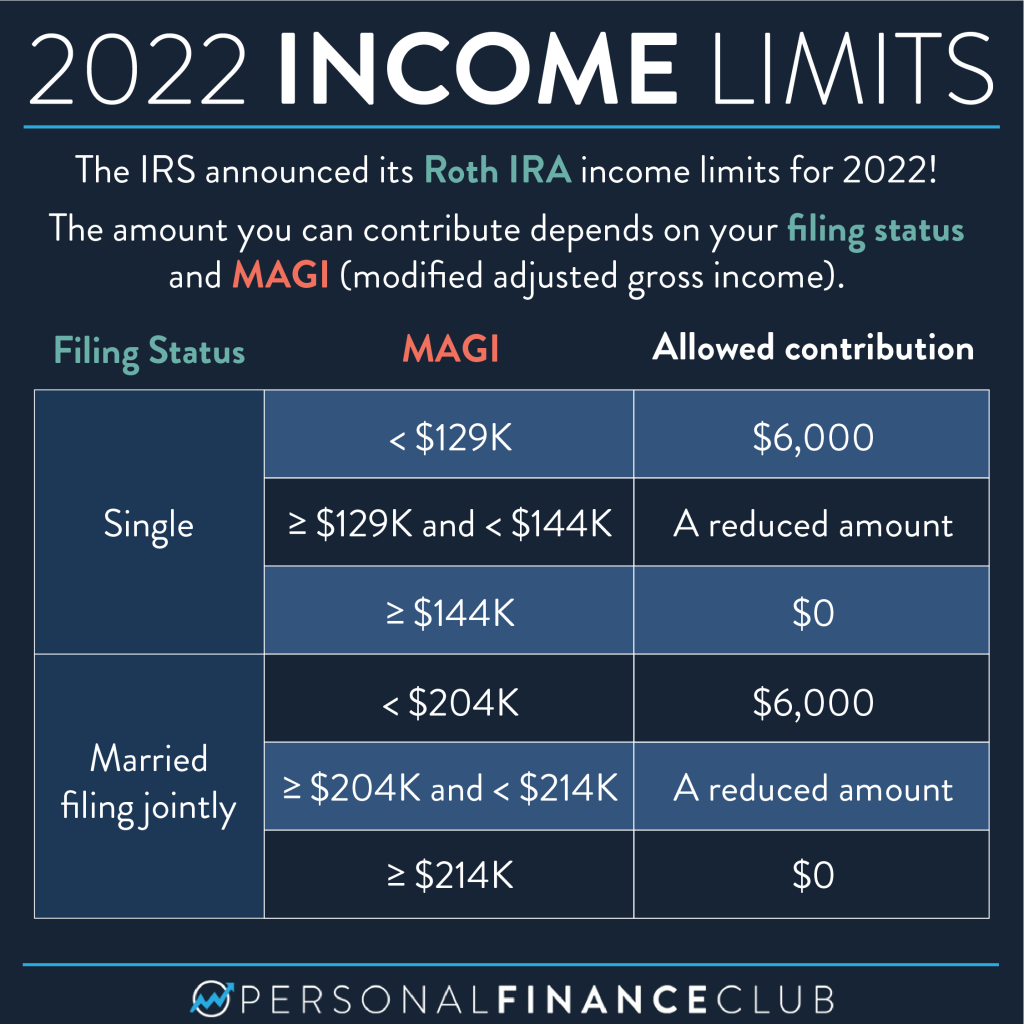

Roth Ira Limits 2024 Chart Moira Tersina, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth accounts.

Source: marisqsteffie.pages.dev

Source: marisqsteffie.pages.dev

Roth Ira Limit 2024 Rheta Pauletta, Limits on roth ira contributions based on modified agi.

Source: tomaqcandide.pages.dev

Source: tomaqcandide.pages.dev

Eligibility For Roth Ira 2024 Ania Meridel, For 2024, the roth ira contribution limits are going up $500.

Source: jandybpriscilla-6ct.pages.dev

Source: jandybpriscilla-6ct.pages.dev

Roth Ira Limits 2024 Joint Withdrawal Charo Casandra, Those are the caps even if you make more, up to the phaseout level.

Source: inflationprotection.org

Source: inflationprotection.org

Understanding the 2024 Changes to Roth IRAs Limits and Opportunities, The same combined contribution limit applies to all of your roth and traditional iras.

Source: cwccareers.in

Source: cwccareers.in

IRS Roth IRA 2024 Contribution Limit 401(k) Increases to 23000, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2024 and 2025 tax years is $7,000 or $8,000 if you are age 50 or older.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, Those are the caps even if you make more, up to the phaseout level.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth accounts.

Source: nancimelantha.pages.dev

Source: nancimelantha.pages.dev

Roth 401k Limits 2024 Tax Selia Cristina, The income limit to contribute the full amount to a roth ira in 2024 is $146,000, up from $138,000 in 2023.